Adding a Tax Type

Tax types are identifiers as to what type of tax is being charged to a customer during a transaction. Tax types are added to tax products in netFORUM. This information is required for passing Level 3 payment information data to the payment processing gateway.

To add a Tax Type, use the following steps:

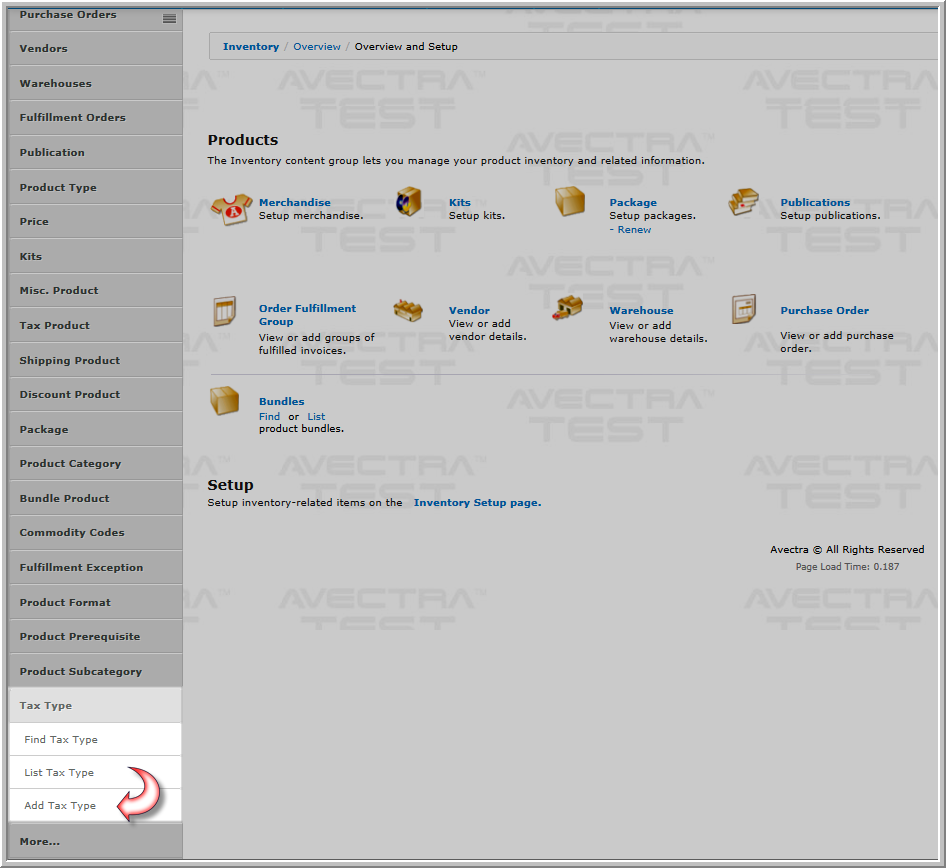

- Go to .

- Expand the Tax Type group item to view the list of available group item links.

- Click the Add Tax Type group item link.The Add - Tax Type Profile page appears.

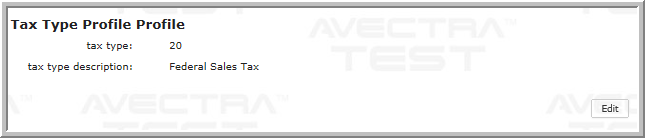

- Enter the numeric code of the tax type in the tax type field. This is the value that will be transferred to the payment processing gateway with the level 3 payment information data.

- Enter a short description of the tax type in the tax type description field.

- Click the Save button.The Tax Type Profile page appears.

The newly added tax type is now available in the tax type drop-down menu which is found in netFORUM.

Note: The actual numeric codes used are governed by various business rules as well as payment processor guidelines.

Sage Payment Solutions

Please consult with Sage Payment Solutions (SPS) on the specific tax type values that you should set up in netFORUM.

For reference, in the netFORUM integration to Sage Payment Solutions, the value entered in the netFORUM tax type for the netFORUM tax product is passed into to the TaxTypeApplied property in the SPS Level III line item.

Vantiv

The netFORUM tax type property is not implemented in the gateway integration to Vantiv.

Tip: Check with your payment processing gateway for any specific rules regarding tax types.